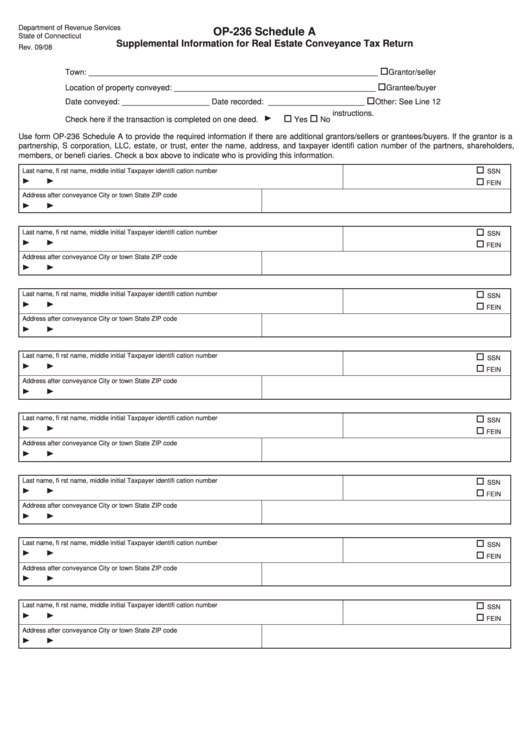

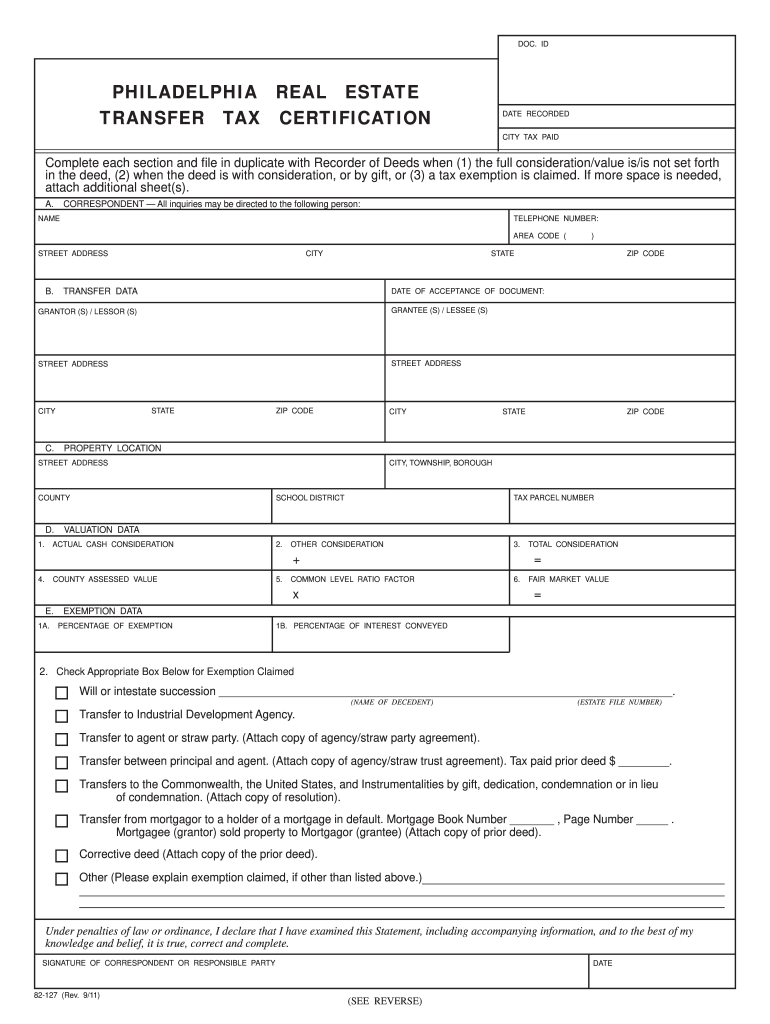

- REAL ESTATE CONVEYANCE FORM REGISTRATION

- REAL ESTATE CONVEYANCE FORM CODE

- REAL ESTATE CONVEYANCE FORM DOWNLOAD

REAL ESTATE CONVEYANCE FORM CODE

As of January 1, 2021, transfers requiring this form will be rejected if an older version without the bar code is submitted.ĭownload DTE FORM 100(EX) Fill in The Exemption from Real Property Conveyance Fee Statement.ĭownload DTE 101 fill in Statement of Conveyance of Homestead Property. Note: The State Department of Taxation has revised the form DTE 100. Please save the form with a new name and then add your information using Adobe Reader)ĭownload the Affidavit for Insertion of Initials on Tax Duplicate available for any: peace officer, parole officer, probation officer, bailiff, prosecuting attorney, assistant prosecuting attorney, correctional employee, youth services employee, firefighter,EMT, medical director or member of a cooperating physician advisory board of an emergency medical service organization, state board of pharmacy employee, investigator of the bureau of criminal identification and investigation, judge, magistrate, federal law enforcement officer, or the spouse of anyone doing these jobs or holding these roles.ĭownload the ET12 FILL IN Estate Tax Application for Consent to Transfer Property (Tax Release Application)ĭownload the ET14_FILL IN Estate Tax Resident Tax Release (also commonly known as inheritance tax waiver form)ĭownload the ET13_FILL IN Estate Tax Employer Death Benefits and Retirement Plans for Resident and Nonresident decedentsĭownload the ET 12A Fill In Application for Consent to Transfer Property (Non Resident Decedent)ĭownload the ET17 FILL IN Ohio Estate & Additional Tax Estimated Payment Noticeĭownload DTE FORM 100 The updated Real Property Conveyance Fee Statement.

REAL ESTATE CONVEYANCE FORM REGISTRATION

Use this form when making a complaint against the CAUV Exemption valuation.ĭownload the Agricultural District Application form hereĭownload the Rental Registration Form (.pdf fillable. This is filed WITH a new 105A application: DTE 105Gĭownload the Addendum to Homestead Exemption for those not filing Ohio an income tax return: DTE 105H fillableĭownload the Homestead Exemption Application for Disabled Veterans and Spouses: DTE 105Iĭownload the Application for the Partial Exemption of a Qualifying Child Care Center: DTE 105Jĭownload the Homestead Exemption Application for Surviving Spouses of Public Service Officers Killed in the Line of Duty: DTE 105Kĭownload the Homestead & Owner Occupany Credit (formerly known as the 2.5%) Appeal form: DTE_106Bĭownload the Owner Occupancy Credit (formerly known as the 2.5%) application: DTE 105Cĭownload the Current Agricultural Use Valuation (CAUV) application form: DTE 109ĭownload the Current Agricultural Use Valuation (CAUV) renewal application form: DTE 109Aĭownload DTE 2 Complaint Against the Assessment of Real Property Other than Market Value.

31ĭownload the DTE23V Renewal Application for Veterans' and Fraternal Organization Tax Exemption (.pdf fillable form) - Renewal must be filed annually with County Auditor by October 1st.ĭownload the DTE24 Tax Incentive Program - Application for Real Property Tax Exemption and Remission (.pdf fillable form)ĭownload the DTE26 Application for Valuation Deduction for Destroyed or Damaged Propertyĭownload the Homestead Application: DTE_105Aĭownload the Certificate of Disability: DTE_105Eĭownload the Addendum to Homestead Exemption for those previously on Homestead who have moved within the county or the state.

REAL ESTATE CONVEYANCE FORM DOWNLOAD

( Only available for download through Ma.)ĭownload the DTE Form 2, the Board of Revision Complaint Against the Assessment of Real Property Other Than Market Value.ĭownload the DTE Form 4 to appeal to the state Board of Tax Appeals a decision made by the Board of Revision (.pdf fillable form)ĭownload the DTE23 Application for Real Property Tax Exemption and Remission (.pdf fillable form)ĭownload the DTE23S Treasurer's Certificate for Exemptions Sought Under ORC 5709.52ĭownload the DTE23N Notice of Loss of the Right to Real Property Tax Exemption (.pdf fillable) - must be filed with County Auditor by Dec. This form also includes guidelines and procedures. File with County Treasurer.ĭownload the fillable DTE Form 1, the Board of Revision Complaint Form Against the Valuation of Real Property.

For Tax Year 2022 form must be filed with the county auditor by March 31, 2023.ĭownload the DTE23A Application for the Remission of Real Property and Manufactured Home Late-Payment Penalties (.pdf fillable form). Download our public records policy and request form (scan and email to Communications Manager David Brown at or submit requests in person or via mail.)ĭownload the DTE 1A Special COVID-19-Related Complaint Against the Valuation of Real Property.

0 kommentar(er)

0 kommentar(er)